Trying to get tariff data. HS Code 39269010 OTHERS Import data in Malaysia from China with product price quantity date of shipment as declared in customs on bill of entry and shipping bill.

HS Code Product Description Country of Origin Value Total US Std.

. A manufactured in Malaysia by a registered manufacturer and sold used or disposed of by him. Note 15 of the HTS. 6-digit Cargo Harmonized System HS code to be stated clearly in the shipping instructions.

And the Freight insurance cost. Tips on how to Sell Internationally. 731816 8701 0501 84714900 etc.

Up to 24 cash back Hs code malaysia pdf 2018 sst EStream Software tariff classification is a complex but extremely important aspect of cross-border trade. Countries are allowed to add longer codes to the first six digits for further classification. Malaysia imports of Slaked lime.

Note 15 of the HTS. Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0. For tax purposes the tariff codes are required on all official shipping documents to ensure a worldwide product classification uniform.

MALAYSIA - Mandatory 6 Digits HS Commodity Code Wednesday October 3 2018 Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia. Simply input a valid HS Code like. The value of your order.

Machine parts or components of plastics. SCOPE CHARGE Sales tax is not charged on. Goods imported from Malaysia or Malaysia are classified under the Agreed Tariff Schedule HTS or are commonly referred to as GS codes.

Tuesday September 25 2018 p Share Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory for the 6 digit HS Code to be declared in the Export Import and transshipment manifest in Malaysia. Why Sellers use Our Services. The United States uses a 10-digit code to classify products for export known as a Schedule B number with the first six digits being the HS number.

For which you would like to analyze and click on search button. Our Malaysia Customs Broker can assist you to calculate import and export Duty charges. Visit us online to get the various hs codes and commodity description.

To calculate the import or export tariff all we need is. Excluding calcium oxide and hydroxide of heading no. HS Nomenclature used HS 198892 H0 HS Code 252220.

Milk cream except condensed milk concentrated in non-solid forms sweetened subject to gen. Persons exempted under Sales Tax Persons Exempted from Payment of Tax Order 2018 Goods listed under Sales Tax Goods Exempted From Tax Order 2018. Middle East.

TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. TRQ as specified in Appendix B TRQ. Please note the following when submitting your shipping instructions.

MALAYSIA - Mandatory HS 6-digits commodity code Dear Valued Customers Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. The codes created by the World Customs Organization WCO classify up to.

Prices of HSCODE 3204 in Malaysia have fluctuated between 0759 to 12332 during the month of Mar-2018. It is a product-specific code as stated in the Harmonised System HS maintained by the World Customs Organisation WCO. Malaysia custom hs code 2202999000 Printed international customs forms carnets and parts thereof in English or French whether or.

There is a. IMPORT DUTY STAGING CATEGORY. Note 15 of the HTS.

Exports is gross exports and Imports is. 010512000 - - Turkeys. Yogurt in dry form whether or not flavored or containing add fruit or cocoa subject to gen.

Butterfat subject to gen. Or b imported into Malaysia by any person. With effect from 1 st October 2018 the Royal Malaysian Customs Department requires the 6-digit HS code to be submitted during importexport manifest declaration.

Sour cream fluid no 45 by wt. For a Complete Price trend of a larger period please order our paid HSCODE 3204 Import ReportYour trusted export import Data provider. The HS assigns specific six-digit codes for varying classifications and commodities.

The complete tariff code length is no less than six digits and can be up to ten also. Genoa 03rd October 2018 Subject.

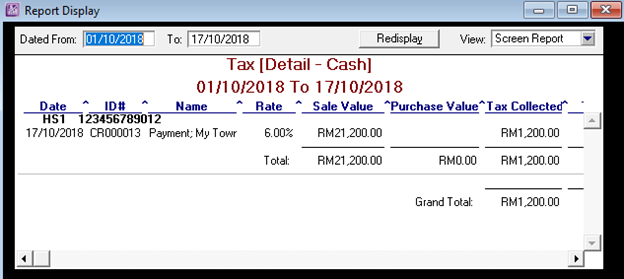

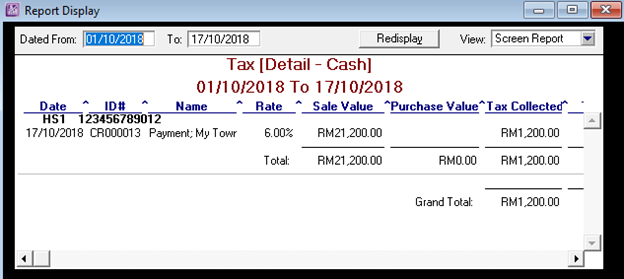

How To Record Tariff Code Using Service Layout Abss Support

What Is Your Hs Code Tariff Business Advisory Services Facebook

Sst Tariff Code Estream Software

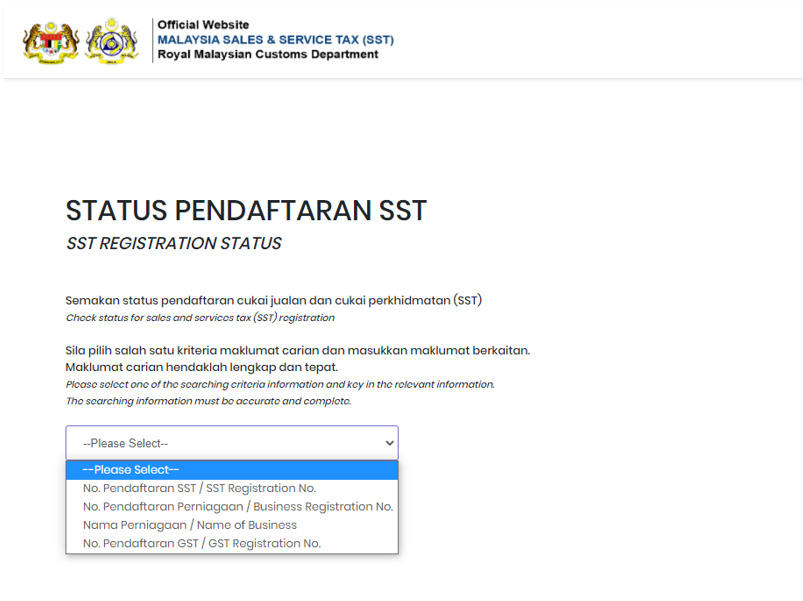

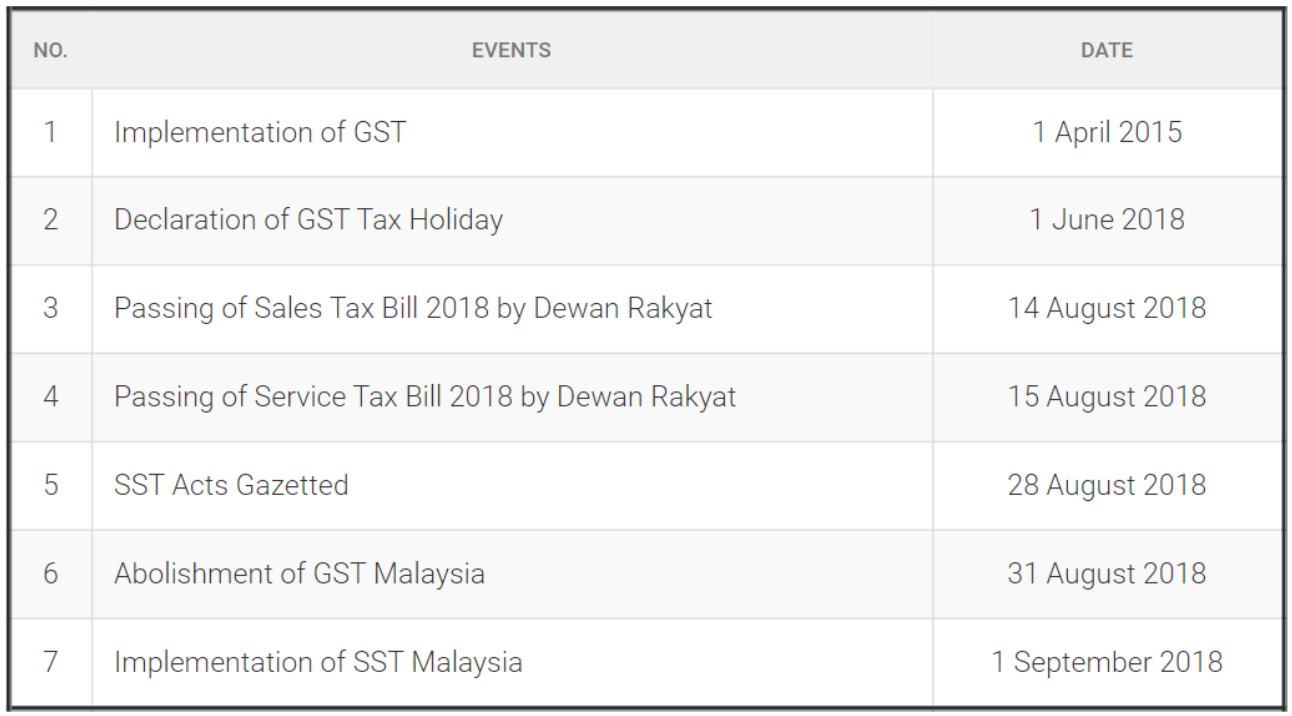

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Maintain Tariff Estream Software

What Is Hs Code The Definitive Faq Guide For 2020

How To Find Hs Code For Export Or Import Products Verified And Tested Pakistancustoms Net Help You To Be An Entrepreneur

Sst Tariff Code Estream Software

What Is Your Hs Code Tariff Business Advisory Services Facebook

China Hs Code Lookup China Customs Import Duty Tax Tariff Rate China Gb Standards Ciq Inspection Quarantine Search Service

Import Requirement Of Wine Hs 2208 And Condition For Trading Wine Vietnam Things

What Is Hs Code The Definitive Faq Guide For 2020

Hts Code Lookup How Much Duty Tariff You Need To Pay

Customs Classification Of Goods Under The Harmonised System Coding Wanfah Prosper Plt 201504000983